A Novel SaaS Credit Product for a Fast-Growing Ecommerce Segment

In Q4 2021, I was brought in by the head of a new team at Capital One to help them research and design their first product. The team's mission was to create scalable SaaS products for new market segments.

The team targeted small and medium businesses (SMBs) in a fast-growing direct-to-consumer ecommerce market segment. This segment was increasingly being targeted by emerging fintech experiences like Buy Now, Pay Later (BNPL).

To create a product well-suited to the needs of this market, we conducted extensive research on both SMB ecommerce merchants and their customers. This case study provides an overview of the user-centered process we employed. While I cannot share detailed product information here; I will discuss themes from our research, and how we incorporated them alongside SaaS best practices to develop a solution that was compelling to these merchants and their customers.

Given the B2B2C nature of these experiences, our process required understanding both our target ecommerce merchants and their customers. Over the course of several weeks, we conducted more than 40 hours of in-depth interviews (IDIs) with individuals who met the following criteria:

20 merchant companies, including:

With both user groups, we structured our interviews in multiple phases. This enabled us to progressively refine our understanding and evolve the discussions from their current experience, to actively iterating on ideas and concepts with both groups.

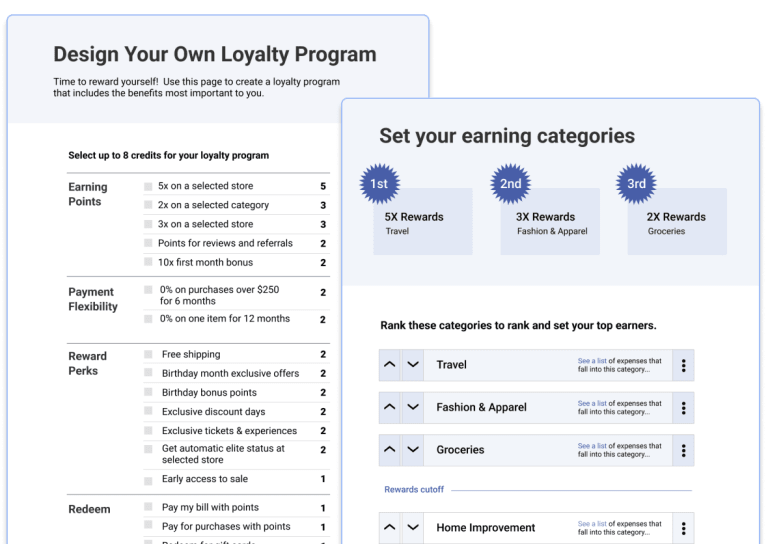

On the consumer side, we focused our intial inteviews on their attitues toward credit adoption, rewards, and loyalty. As in all phases of the research, we used extensive stimuli (wireframes, concept screens, etc.) to help capture their preferences and dispositions.

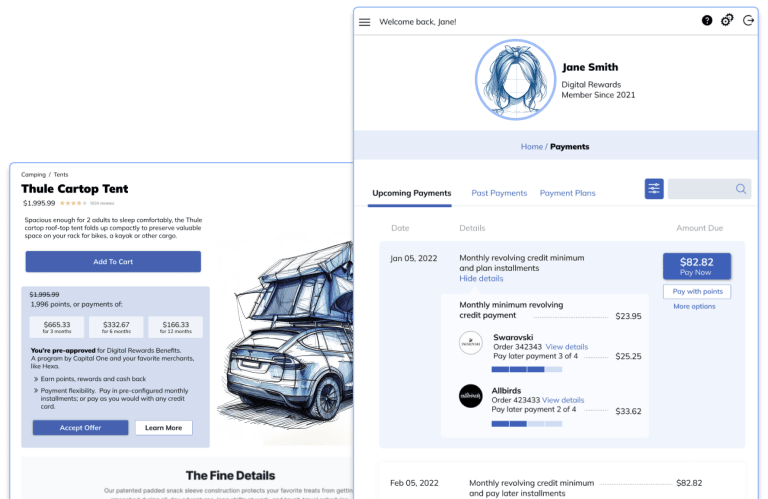

In subsequent consumer interviews, we used wireframes to generate feedback on how these attitudes might manifest within the context of e-commerce and account management journeys.

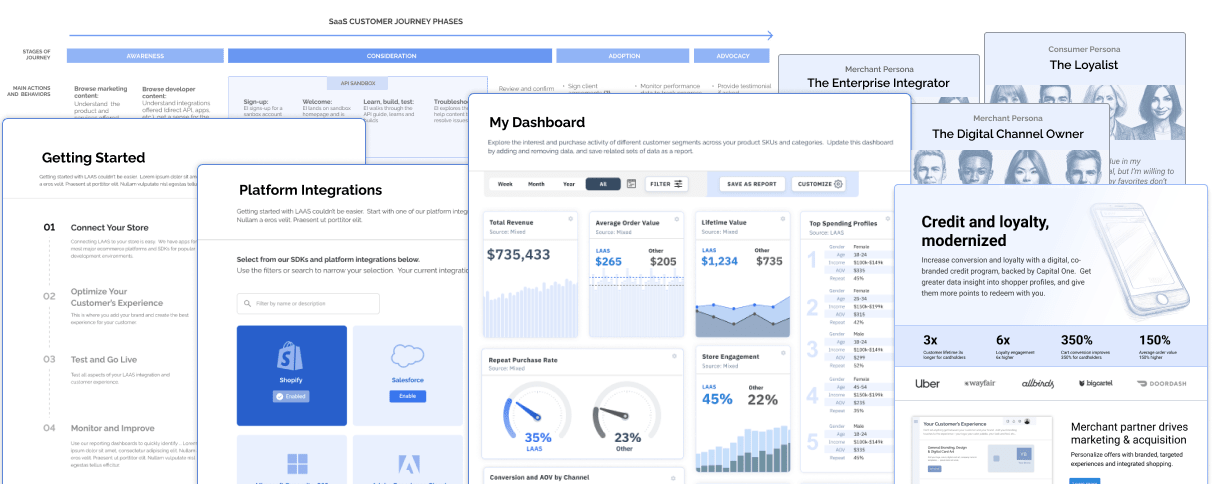

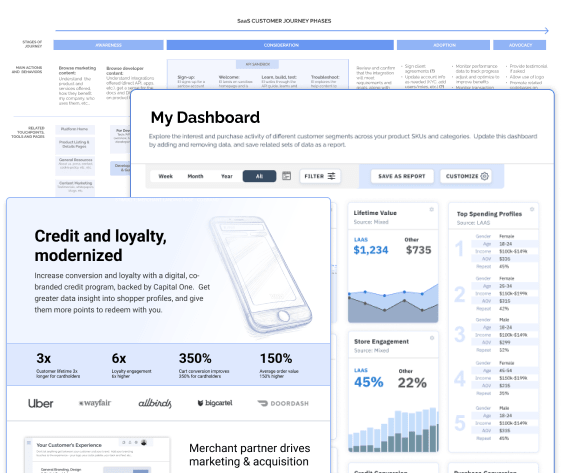

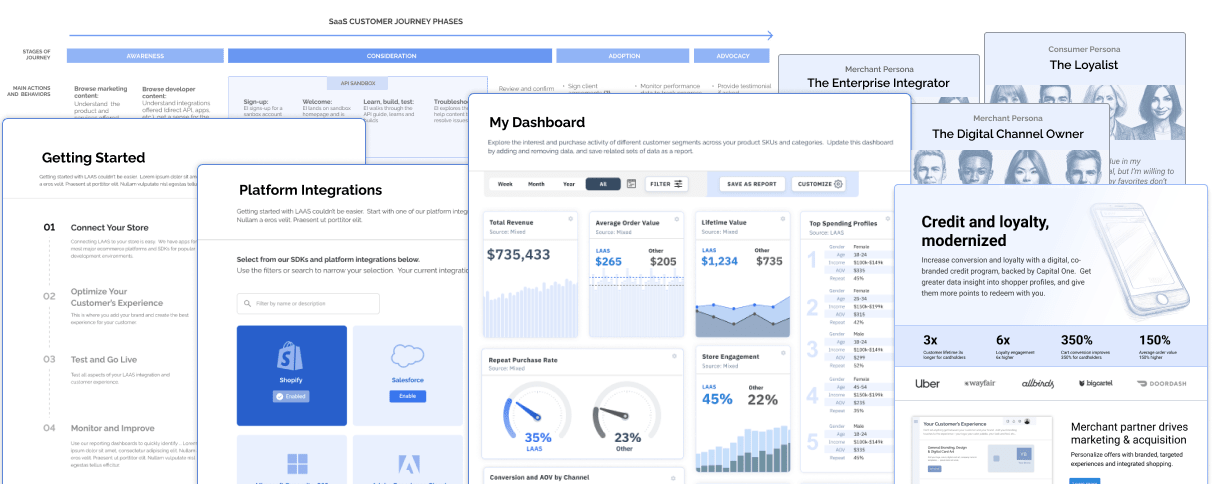

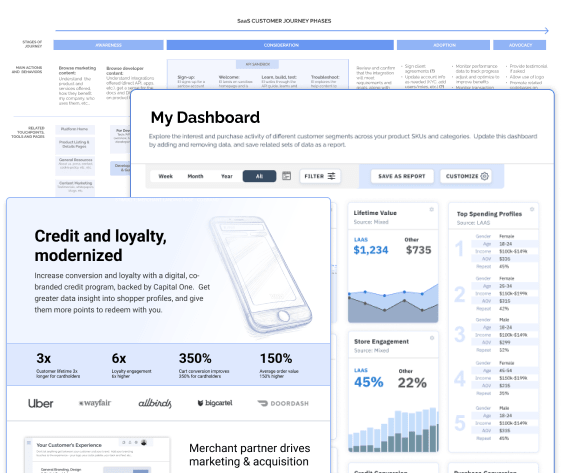

Similarly, on the merchant side, we staged our interviews in phases. Our early interviews focused on their experiences with existing credit and loyalty programs, and attitudes towards potential new SaaS initiatives. We specifically sought to understand pain points and decision making in their SaaS customer journeys.

In later discussions, we shifted to testing and iterating on product concepts and positioning - applying and vetting the insights we had collected from prior rounds of interviews. A few themes started to emerge.

Research Theme

Our merchants consistently faced project backlogs, with the volume of initiatives exceeding resources available. In the current environment, any new initiative would need strong a justification for consideration, and have to compete against existing projects. Combining quantified, testable business gains with a low level-of-effort trial positioned potential initiatives most favorably against most existing projects.

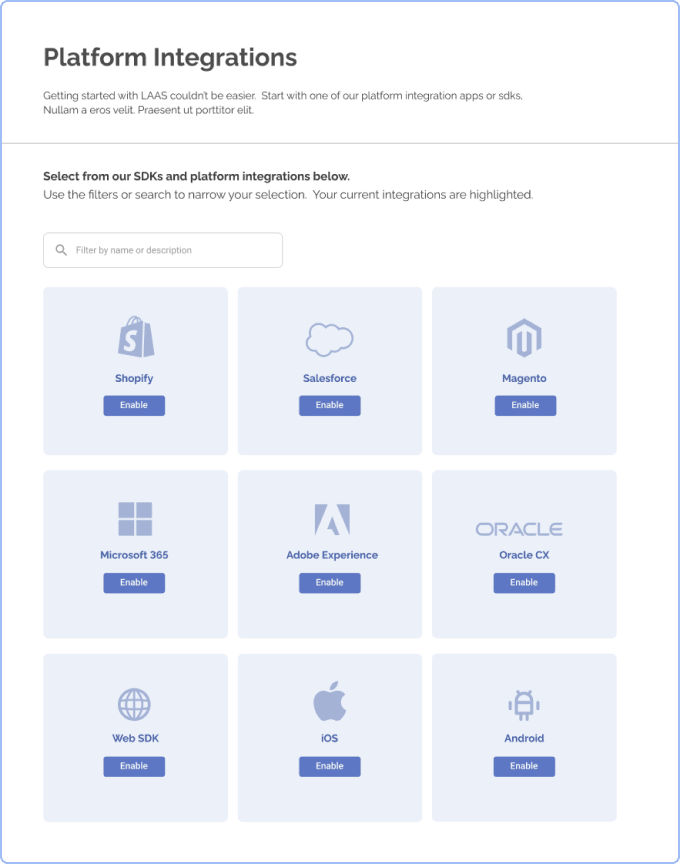

On the low-effort front, one attractive strategy was low-code/no-code integrations into popular ecommerce and customer experience platforms.

Research Theme

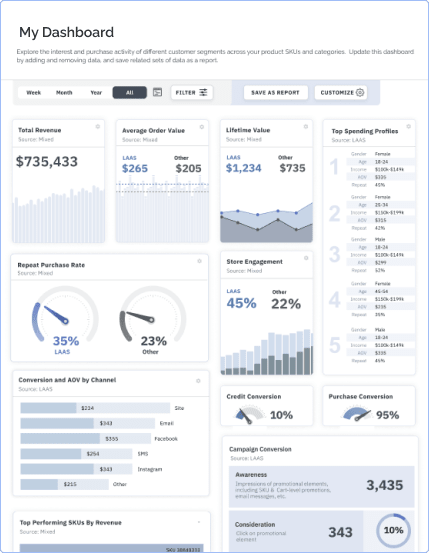

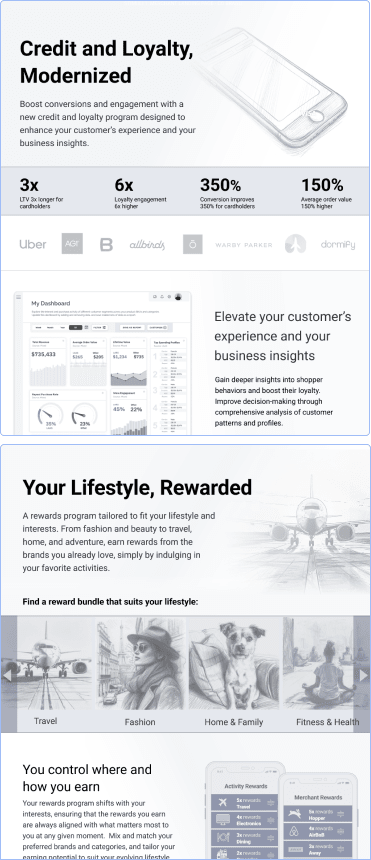

Our merchants consistently expressed a high demand for data and analytics. With recent shifts in browser and platform privacy, many were already investing in external data sources.

Acknowledging the importance of data in the value proposition to these merchants, we focused on the potential customer insights from 1st-party program data in every iteration of our concepts.

Research Theme

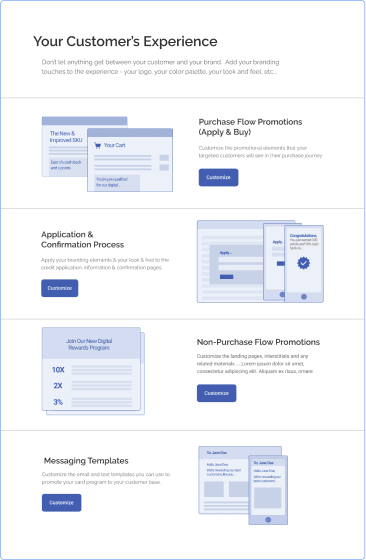

Understandably, merchants voiced their concerns about potential disruptions in ecommerce flows. They trusted Capital One to create a seamless apply-and-buy experience; nevertheless, they wanted granular control over how and where the product impacts their customer's experience. Our look at the market landscape, and our discussions with these merchants highlighted that extensive non-technical customization is becoming the table stakes of a good SaaS experience. As we got deeper into product constructs, each meaningful customer touchpoint and feature included extensive non-technical customization with "smart defaults".

Research Theme

Single-brand credit constructs in this market segment were not very compelling to our consumers. (They were even of dubious value to many merchants.) One of the primary reasons is that many merchants at this level are very specialized and don't command extensive wallet share or transaction volume with individual consumers. For example, the purchase of eyeglasses or luggage can be well above-average consumer's typical order value; but they aren't purchased very often on their own. However, constructs that bundled multiple specialized brands around common interest or activitys were attractive - like travel, fashion, wellness, etc.

After finding product concepts that resonated with both our merchants and consumers, I moved on to scaffolding a full product experience in wireframes and prototyping.

We presented our process, findings and prototypical product experience to senior management and stakeholders, and it was very well recieved. As a result, the team received a wider mandate. We were tasked with creating an enterprise-wide SaaS platform capable of commercializing any future product while incorporating the best practices validated by our research and exemplified in the product experience.

I was invited to extend my engagement. I intend to present the details of the research, design and development of this platform in a separate case study. In the meantime, if you'd like to see and hear more, please contact me.